On February 15, 2022, Munich Reinsurance Company violated the relevant provisions of the Anti monopoly Law of China due to its failure to report to the State Administration of Market Supervision in accordance with the law before acquiring the equity of Kavanta Europe Assets Co., Ltd., which constituted an illegal concentration of business operators, and was fined 300000 yuan. “Failure to declare concentration of business operators according to law”, the same reason, we saw in the “CITIC Baixin Bank case” last year.

So, what is concentration? Why does a listed company registered in Germany encounter antitrust penalties in China?

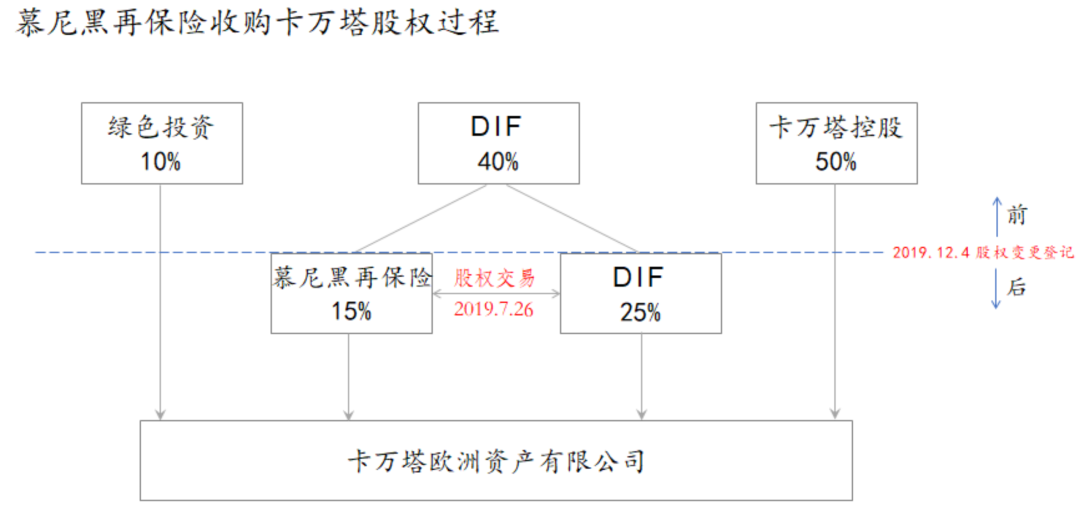

From Figure 1, we can clearly see that on July 26, 2019, Munich Reinsurance acquired the joint control of Kavanta by purchasing 15% equity from the original shareholder DIF of Kavanta, which belongs to the concentration of business operators specified in Article 20 of the Anti monopoly Law.

The so-called concentration of business operators refers to the fact that the operator obtains the control right of other operators or can exert decisive influence on other operators through merger, or by obtaining equity or assets, or by contract. In addition to equity and asset control, operators may also control or exert influence on their operators through technical arrangements, intellectual property rights and personnel, which also belongs to business concentration. Because concentration of undertakings may result in monopolistic behaviors that eliminate or restrict competition in the relevant markets, general countries implement the system of prior declaration for concentration of undertakings, and concentration shall not be implemented if it is not declared in advance, otherwise it will be investigated for corresponding punishment.

Then, why does Munich Reinsurance suffer from anti-monopoly investigation in China?

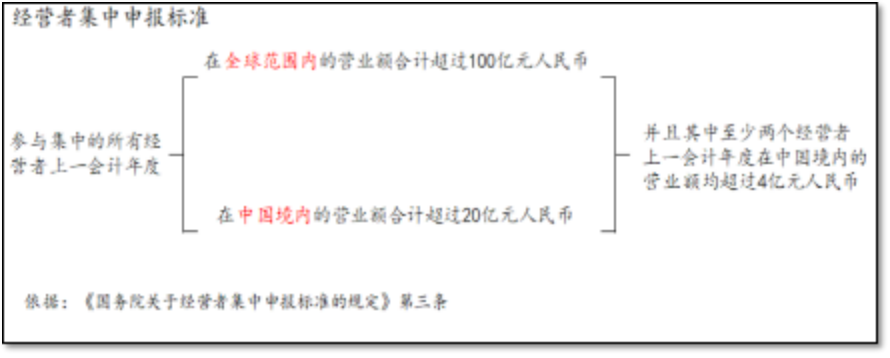

This is related to the corporate nature of Munich Reinsurance, as well as China’s reporting standards. According to the survey results of the State Administration of Market Supervision, Munich Reinsurance was registered in Germany in April 1880 and listed on the Frankfurt Stock Exchange in 1888. Its ownership structure is decentralized and there is no ultimate controller. In 2018, the last year of equity transaction in 2019, Munich Reinsurance and participating in the concentration of another operator’s green investment, as well as the global turnover of the acquired Kavanta and the turnover in China, all reached the standard specified in Article 3 of the Provisions of the State Council on the Reporting Standards for Concentration of Operators (see Figure 2), which belongs to the situation that should be reported.

On December 4, 2019, the registration of changes in Kavanta’s equity was completed. Prior to this, Munich Re failed to report in accordance with the law, violating the relevant provisions of Article 21 of the Anti monopoly Law that should be reported in advance, which constituted an illegal concentration of operators, so it was punished.

The purpose of anti-monopoly is to oppose unfair competition. Therefore, when conducting the declaration and review of the concentration of business operators and the illegal investigation, the market supervision department will also assess whether the concentration has or may have the effect of eliminating or restricting competition. If it has, it must be prohibited, and shall order the suspension of the concentration, the restriction of the disposal of shares or assets, the transfer of business within a time limit, and take necessary measures to restore to the state before the concentration, and impose a fine of less than 500000; If it is assessed that the concentration does not have the effect of eliminating or restricting competition, the concentration may not be prohibited. However, if the concentration is implemented without reporting in advance, the law enforcement department will impose a fine of less than 500000 according to the nature, extent and duration of the illegal act.

The “CITIC Baixin Bank Case” and the “Munich Reinsurance Company Case” mentioned in this article are all cases of illegal concentration without prior declaration, but without the effect of eliminating or restricting competition. Therefore, they are only fined.

In a word, we can see from the Munich Reinsurance Company’s anti-monopoly punishment case that the operators have encountered anti-monopoly compliance problems when conducting joint ventures, mergers and acquisitions and other concentration activities. This case also well deduces the application, enforcement review, punishment and other issues of China’s anti-monopoly law on concentration, which is worthy of attention and reference.

Lawyer Wang Fen

Graduated from the Northwest Institute of Political Science and Law, Economic Law Department, with nearly 10 years of legal service experience, and high customer satisfaction;

Advocate that the law should serve the business, be able to go deep into the frontline of the consulting unit, and provide the consulting unit with operable and valuable services that can pre control risks;

It can independently research and develop topics and provide daily legal training for enterprises, including labor law, contract law, shareholder disputes, intellectual property rights and competition law.

您的浏览器当前宽度低于1400px;请使用1400px以上宽度访问。